Grow markets and capture value

Aspiration: Growers have access to a diversity of markets and get more for the crop.

Seizing new and existing market opportunities and reducing post-farm gate costs provides growers with choice, opportunities to capture more value and help manage price risk.

The Australian grains industry is well placed to meet market need and capitalise upon strong demand from a growing, increasingly affluent population. Our industry has a successful track record of establishing new markets, maintaining or growing existing ones, supported through RD&E investment. Gaining access for Australian canola into China or maintaining access into the European market are just two examples that have helped provide market choice and put more dollars in growers’ pockets. The provision of high-quality grain functionality data, breeding to end-use requirements, and robust classification systems are other examples of this.

Recognising grain prices, markets and supply chains are volatile and driven by factors largely beyond our direct control, RD&E plays a critical role in helping growers and industry to remain cost competitive, support reliability of supply, and capture value through differentiation. Intensified RD&E effort will be made over the next five years to support the identification and capture of market, price and post-farm gate cost opportunities. Collaboration and alignment across the grains industry will be critical to make choices that focus our effort on realising the most important and profitable opportunities.

Enduring access to a diversity of markets

In a deregulated environment, keeping abreast of the big picture and market signals is critical. Investment in this area aims to understand domestic and global grain markets to support ongoing access to a range of existing and new markets to mitigate risk. GRDC cannot directly undertake marketing or advocacy, however we can invest in RD&E that supports market growth or creates competitive advantage. Understanding what end users want now, and in the future enables us to focus R&D effort and inform decisions to ensure we breed, classify, grow and supply grain that markets prefer.

Add value to the crop to increase margins

Knowing what markets want allows us to explore opportunities to enhance or differentiate Australian grain to get more for the crop. Opportunities exist to be the first mover into new and emerging high value markets and grow existing markets. Value-add or differentiation opportunities in areas such as grain functionality, food safety, human health and sustainability should be driven by market demand. Investment can help ensure our varieties, agronomy, grading, classification, segregation and systems are fit-for-purpose to meet market requirements.

Lower post-farm gate costs

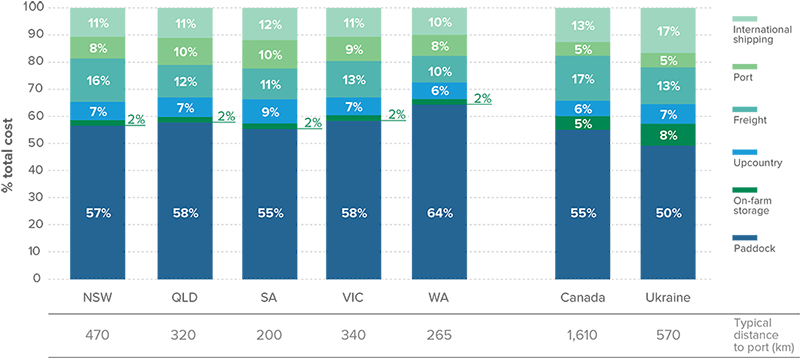

Post-farm gate costs represent a significant proportion of the total cost of grain delivered to market. A range of factors influence the efficiency and competitiveness of Australia’s grain supply chain. Whilst estimates vary and depend on a range of factors, supply chain costs represent around 30-35 per cent of the total free on board cost of grain (excluding international shipping) (16), starting at around $60-70/t for wheat (17). Seasonal variability in the size of the crop poses major challenges to logistics, segregation and Australia’s ongoing ability to handle the crop. RD&E that supports reductions in post-farm gate costs provides opportunity to improve the long-term competitive position of the Australian grains industry and put more dollars in growers’ pockets. This area of focus may include RD&E to help co-ordinate infrastructure investment, transport, handling and storage innovations

Real breakthroughs (to reduce post-farm gate costs) are needed. There are opportunities that have not been tried.

Supply chain components as a proportion of the total delivered cost of wheat into Indonesia for Australia, Canada and the Ukraine (2019/20), excluding levies and check-offs (16).

Note: Adapted from L.E.K. report on international comparison of Australia's freight and supply chain performance and refer to context and disclaimer when interpreting, including consideration of differences in transport distance. Included as an example only, recognising costs are a snapshot in time, are influenced by numerous variables and have not been updated to consider global events and circumstances having occurred since.

16. L.E.K. Consulting Australia Pty Ltd. (2020). International Comparison of Australia’s Freight and Supply Chain Performance.

Final Report. December 2020. Report prepared for the Commonwealth of Australia as requested by the Department of

Infrastructure, Transport, Regional Development and Communications. International Comparison of Australia’s Freight and

Supply Chain Performance | L.E.K. Consulting (lek.com)

17. White, P., Carter, C., and Kingwell, R. (2018). Australia’s grain supply chains. Costs, risks and opportunities. Australian Export

Grains Innovation Centre, 3 Baron-Hay Court, South Perth, Western Australia 6151. Australia’s grain supply chains: costs,

risks and opportunities – Aegic | Australian Export Grains Innovation Centre